The Three Black Crows Pattern

What is the Three Black Crows Pattern?

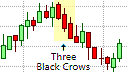

The Three Black Crows Pattern

The Three Black Crows pattern is the opposite of the Three Advancing White Soldiers candlestick pattern. The Three Black Crows candlestick pattern is a bearish reversal pattern that consists of three bearish candlesticks that are ominous and dark in color, hence the name. This is a moderate trend reversal pattern that should only come into consideration when it appears in a rally or an established uptrend. The Three Black Crows usually indicates a weakness in an established uptrend and the potential emergence of a down trend.

The Three Black Crows Formation

Each of the three candlesticks that make up the Three Black Crows pattern should be relatively long bearish candlesticks with each candlestick closing at or near the low price for that trading session. Each successive candlestick should mark a steady decline in price and should not have long lower shadows or wicks. Each of the three candlesticks should also open within the real body of the preceding candlestick in the pattern but this is not essential.

What the Three Black Crows Pattern tells us

The three bearish candlesticks in the Three Black Crows pattern appearing in an existing uptrend spells potential danger for the bulls. The three successive lower lows and lower highs of these candlesticks reflects an increase in the strength of the bears that could result in a possible transition to a bearish trend reversal. However, if the three candlesticks are over extended and make significant price declines it may lead to oversold conditions.

Trading the Three Black Crows

The Three Black Crows pattern is a bearish reversal pattern that forewarns of weakness in the uptrend and a possible transition to a trend reversal. This implies that the bullish uptrend coming to an end is more likely than it continuing. Traders with open long positions should, therefore, look the exit their positions on the opening of the next candlestick. Traders would also be anticipating the emergence of a downtrend and will be looking to be short, which means they will also be preparing to place sell orders on the opening of the candlestick that follows the Three Black Crows pattern.

Since a short position would be taken against the current trend, a protective stop-loss order should be used to limit the risk of the pattern failing. This protective stop could be placed just above the high of the highest candlestick in the formation. A price break above this level would negate the pattern. However, if the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the high of the pattern before entering the trade. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur. Remember that confirmation of the pattern must first be obtained before placing a sell order.

The Three Black Crows pattern does not provide a clear profit target. Instead, a trader could implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

As with most trend reversal patterns, the Three Black Crows pattern becomes more reliable depending on where it appears on the price chart in relation to trendlines, pivot points, and support and resistance lines, etc. An Three Black Crows pattern at or near an upper trendline or resistance line can be used in anticipation that the test of the trendline or resistance line is not likely to break it. The resulting price decline following the failure to break the trendline or resistance line should give greater impetus to the pattern. Also, if the Three Black Crows pattern is formed at an all-time high, it becomes more significant as the market could be overbought. Here traders can use the Three Black Crows pattern in conjunction with an oscillating indicator, such as the RSI, that shows the security to be overbought.

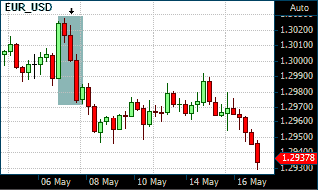

Chart Example

The Three Black Crows can be seen in the shaded area on the following 15-minute Euro/USD Forex chart. The Three Black Crows were made from a double tops level at around 1.30249 that was made at 2:15 AM and at 11:00 AM on May 14, 2013.

Three Black Crows Pattern on the 15 Minute EUR/USD chart