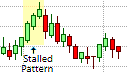

The Stalled Or Deliberation Candlestick Pattern

What is the Stalled Pattern?

The Stalled or Deliberation Pattern

The Stalled candlestick pattern, which is also referred to as the Deliberation candlestick pattern, is a moderate trend reversal pattern that is similar to the Advance Block and the Three Advancing White Soldiers patterns. The difference between the Stalled pattern and the Advance Block pattern lies in the shadow or wicks. These triple candlestick patterns are all moderate patterns that indicate a weakening of the existing trend rather than an outright reversal of that trend. Like the Advance Block pattern, the Stalled pattern must appear in an established uptrend where it usually indicates a weakening of the uptrend that could result in the emergence of a bearish downtrend.

The Stalled Formation

The Stalled pattern is similar in formation to the Advance Block pattern as it also consists of three bullish candlesticks that are light in color, with each successive candlestick in this pattern making a higher high as well as a higher low. Each successive candlestick also has a progressively shorter real body than the preceding candlestick in the pattern. In the Stalled pattern, the first two candlesticks must have shortish shadows while the last candlestick must have a relatively long upper shadow and a relatively short real body. This small candlestick can either gap away from the longer real body of the preceding candlestick, or it can form at the upper end of the previous candlestick's real body.

What the Stalled Pattern tells us

The successively shorter real bodies of the candlesticks that form the Stalled pattern indicate an increasing weakness in an uptrend as successive candlesticks fail to advance the price to the same extent as the previous candlestick. This is a clear indication that the strength of bulls is deteriorating. The longer upper shadow on the last candlestick indicates that the market retreated much more than before, showing even deterioration in the strength of the bulls. This warns of a potential end to the rally. However, as the candlesticks that form the bearish Stalled pattern are still bullish, light-colored candlesticks, the Stalled pattern is a moderate pattern and it does not necessarily indicate a transition to a downtrend.

Trading the Stalled

As the Stalled pattern is only a moderately reliable bearish reversal pattern that consists of bullish candlesticks, caution should be taken when trading the Stalled pattern. This pattern should not be used to enter a short position but it serves to warn that you should be ready to protect any open long positions. After the Stalled pattern has completed, a subsequent move of the price chart below the middle of the second candlestick’s real body, a bearish reversal becomes more likely and traders could consider closing their long positions. Should the Stalled pattern be followed by the appearance of another bearish candlestick pattern, such as the Hanging Man or the Evening Star pattern, it would signal the start of a possible transition to a downtrend and could be used to enter a short position.