The Kicker Candlestick Pattern

What is the Kicker Pattern?

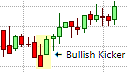

The Bullish Kicker Pattern

The Kicker pattern is a significant trend reversal candlestick pattern that predicts a change in the sentiment and direction of the market. It is quite a reliable pattern that heralds either a bullish or bearish reversal of the current market direction, depending on the trend that it appears in. The Kicker pattern is also a double candlestick pattern that consists of two Marubozu candlesticks.

The Kicker Formation

The Kicker pattern should appear in an existing trend. The first candlestick in the pattern should be a relatively large Marubozu that is very supportive of the current trend. The second candlestick should also be a relatively large Marubozu that nullifies the preceding candlesticks price movement as it gaps against the current trend to open at the same level as the open of the previous Marubozu candlestick. This is a defining characteristic of the Kicker pattern.

The Bullish Kicker Formation

The bullish Kicker pattern can appear in a well-defined downtrend. The first candlestick in the pattern is very supportive of the current downtrend. It opens at or very near its high and closes at or very close to its low, which is lower than its open, making it a bearish Marubozu. The second candlestick all but nullifies the preceding candlestick's movement as it gaps up on open to open at the same level that the previous candlestick opened. The second candlestick then moves higher to close at or very near its high making it a bullish Marubozu.

What the Bullish Kicker Pattern tells us

The bullish version of the Kicker pattern forms during a downtrend. The market has a very negative sentiment towards underlying security as its price continues to fall. The first candlestick in the pattern is indicative of the negative sentiment and supportive of the current downtrend as the price closes much lower than its open. However, the second candlestick all but nullifies the preceding candlestick as it gaps up to open above the real body of the previous candlestick and then closes even higher following a positive news release related to an unanticipated improvement in the fundamentals of the underlying security. The second candlestick shows a clear shift in the market sentiment towards the underlying security. Traders now view the underlying security as a good investment following the positive news and could be expected to close their short positions. Hence, the market could be expected to reverse direction and transition to a new uptrend.

Trading the Bullish Kicker Pattern

The bullish Kicker is a significant trend reversal pattern; therefore, traders will be looking to go long (buy) in the market in anticipation of the possible transition to a bullish uptrend. Traders that are currently holding short positions should be looking to cover their short positions and would be preparing to place buy orders. After the formation of a Bullish Kicker pattern, a trader can enter into a long (buy) trade on the open of the next candlestick. A protective stop loss should be placed at the low of the pattern, which would be the low of the previous candlestick. A price break below this level would negate the pattern making it a logical place to put a stop loss. If the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible retracement back towards the low of the second candlestick in the Kicker pattern. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a retracement will take place.

The bullish Kicker pattern does not provide a clear profit target; therefore, other trading mechanisms or methods, such as a previous support or resistance area, a measured moved defined by an acceptable risk/reward ratio, a key Fibonacci retracement level, the appearance of a bearish candlestick formation, or a simple trailing stop.

As with most trend reversal patterns, the bullish Kicker pattern becomes more reliable when it appears near a trendline, a pivot point, or a support and resistance line, etc. A bullish Kicker pattern that forms at or near a lower trendline or a support line can be used in anticipation that the test of the trendline or support line is not likely to break it. As a result, the price should be expected to climb, giving greater impetus to the pattern. Also, if the bullish Kicker pattern is formed at a low-price level or in an extended downtrend, it becomes more significant as the market could be in an oversold condition. Here traders can use the bullish Kicker pattern in conjunction with an oscillating indicator, such as the RSI, to confirm that the security is oversold.

The Bearish Kicker Formation

The bearish Kicker pattern is the opposite of the bullish Kicker pattern and can appear in an established uptrend. The first candlestick in the pattern is very supportive of the current uptrend. It opens at or very near its low and climbs to closes at or very close to its low, which is much higher than it's open. This makes it a bullish Marubozu. The second candlestick in the pattern nullifies the preceding candlesticks gains as it gaps down to open lower than the level at which the previous candlestick opened. The second candlestick then moves steadily lower to close at or very near its low for the session, making it a bearish Marubozu.

What the Bearish Kicker Pattern tells us

The bearish Kicker pattern forms during a strong rally with the market portraying a very positive sentiment towards underlying security. The first candlestick in the bearish Kicker pattern is indicative of the positive market sentiment and is supportive of the current uptrend as the price continues to climb strongly. However, following a significant news event related to the underlying security, the second candlestick nullifies the preceding candlestick as it gaps down on open to open lower than the previous candlestick. The second candlestick shows a clear, negative shift in the market sentiment towards the underlying security. Previously bullish traders could be expected to exit their long positions and, hence, the market could transition to a reverse direction as a sell off of the underlying security could be expected.

Trading the Bearish Kicker Pattern

Trading the bearish Kicker pattern is the inverse of trading the bullish Kicker pattern. Here, weakness in an existing uptrend and a possible transition to a trend reversal is implied. This suggests that the bullish uptrend should be coming to an end. Traders with open long positions should, therefore, look for opportunities to exit their short positions and then prepare to go long. The trader could place a sell order on the open of the next candlestick. A protective stop loss should be placed at the high of the first candlestick in the pattern as a price break above this level would negate the pattern. If the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the high of the second candlestick in the bearish Kicker pattern. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur.

The bearish Kicker pattern does not provide a clear profit target bur a trader could implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

As with the bullish Kicker pattern, the bearish Kicker pattern becomes more reliable depending on where it appears on the price chart in relation to trendlines, pivot points, and support and resistance lines, etc. A bearish Kicker pattern at or near an upper trendline or resistance line can be used in anticipation that the test of the trendline or resistance line is not likely to break it. The resulting price decline following the failure to break the trendline or resistance line should give greater impetus to the pattern. Also, if the bearish Kicker pattern is formed at an all-time high, it becomes more significant as the market could be overbought. Here traders can use the bearish Kicker pattern in conjunction with an oscillating indicator, such as the RSI, that shows the security to be overbought.