The Concealing Baby Swallow Candlestick Pattern

What is the Concealing Baby Swallow Pattern?

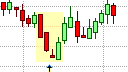

The Concealing Baby Swallow

The Concealing Baby Swallow pattern, which is known as kotsubame tsutsumi in Japanese, is a rare bullish trend reversal pattern that can mark the start of a transition from an established downtrend to an uptrend. It consists of four candlesticks that, while they are bearish and dark in color, indicate that the strength of the downtrend is dissipating and warns of a possible transition to an uptrend.

It is similar to the bullish Ladder Bottom pattern, though the latter has one more candlestick than the Concealing Baby Swallow pattern. In addition, the Concealing Baby Swallow pattern also contains the bullish Inverted Hammer pattern and the bullish Engulfing pattern.

The Concealing Baby Swallow Formation

The Concealing Baby Swallow consists of four bearish, dark-colored candlesticks that have consecutive lower closing prices. The first two candlesticks in the pattern take the form of large bearish Marubozu candlesticks that close at or near the low price for that trading session or period and have little or no lower shadows. These two can have overlapping real bodies, i.e., second candlestick can open within the area of real body of the previous candlestick. The third candlestick in the pattern gaps down from the close of the previous candlestick but then rebounds into the real body of the previous candlestick before turning back to close near its low, forming an Inverted Hammer. The last candlestick in the Concealing Baby Swallow pattern gaps up above the upper shadow of the previous candlestick but then pulls back to completely engulf the previous candlestick.

What the Concealing Baby Swallow Pattern tells us

The first two candlesticks in the Concealing Baby Swallow pattern are large bearish Marubozu candlesticks that are supportive of the current downtrend and indicate that the downtrend still has considerable strength. At the same time, the overlapping real bodies indicate that there is some buying pressure that is challenging the strength of the bearishness. The third candlestick, however, clearly shows some weakness. It gaps down on open but then fails to drive the market significantly lower. Instead, the third candlestick retraces into the real body of the previous candlestick before closing lower, forming an Inverted Hammer, which is itself a reversal signal. The last candlestick in the pattern is again a bearish candlestick that completely engulfs the preceding candlestick. The market, at this point, can be considered well oversold, and market participants should anticipate a possible trend reversal.

Trading the Concealing Baby Swallow Pattern

The Concealing Baby Swallow Pattern is a bullish trend reversal pattern that warns of increasing weakness in an existing downtrend and the probable end of the downtrend. Traders with open short positions should be looking to cover their short positions on the open of the candlestick that follows the Concealing Baby Swallow formation, and will be looking to go long, which means they will be preparing to place buy orders. Traders may initiate a buy (long) order at the high of the last candlestick in the pattern with a protective stop placed just below the low of the same candlestick. This should also be the low of the entire Concealing Baby Swallow formation and should not be too far from the entry point. Therefore, it should provide a decent risk/reward for the trade.

The minimum profit target for the Concealing Baby Swallow pattern is equal to the size of the entire formation, measured from the high of the first Marubozu in the pattern to the low of the last, engulfing candlestick in the pattern. A trader could also implement a profit target based on a measured moved defined by an acceptable risk/reward ratio or a simple trailing stop.

As with most trend reversal patterns, the Concealing Baby Swallow pattern becomes more reliable when it appears in the vicinity of a lower trendline, a pivot point, or support line, etc. A Concealing Baby Swallow pattern that forms at or near a lower trendline or a support line can be used in anticipation that the test of the trendline or support line is not likely to break it. As a result, the price should be expected to climb, giving greater impetus to the pattern. Also, if the bearish Concealing Baby Swallow pattern is formed at a low-price level or in an extended downtrend, it becomes more significant as the market could be in an oversold condition. Here traders can use the bearish Concealing Baby Swallow pattern in conjunction with an oscillating indicator, such as the RSI, to confirm that the security is oversold.

As always, disciplined money management should be exercised when trading the market.