The Belt Hold Line Candlestick Pattern

What is the Belt Hold Line Pattern?

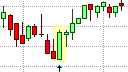

The Bullish and Bearish Belt Hold Line Patterns

The Belt Hold Line candlestick pattern is considered a minor trend reversal pattern that can indicate a bullish or bearish trend reversal, depending on the nature of the pattern and direction of the trend in which it appears. The Japanese name for the pattern is yorikiri, which is term used in sumo wrestling that translates loosely to "pushing your opponent out of the ring while holding onto his belt". This is a good description of the pattern.

The Belt Hold Line pattern is a single candlestick pattern that almost takes the form of a Marubozu candlestick in that it is has a large real body, which indicates the extent of the strength of bullish or bearish activity during the session. However, the Belt Hold Line is only shaven at the end at which it opened, and is called an Opening Bozu.

The Belt Hold Line pattern can be a bullish or bearish trend reversal pattern, depending on the nature of the trend that it appears in. When it appears at a high-price level in an uptrend, it marks the potential end of that uptrend. Similarly at a low-price level in a downtrend, it marks the potential end of that downtrend.

The Belt Hold Line Formation

The Belt Hold Line pattern consists of a single candlestick that must appear in an existing trend. This candlestick opens by gaping away from the real body of the previous candlestick, in the direction of the prevailing trend. However, the candlestick proceeds to close the window (gap) immediately and penetrates the real body of the previous candlestick before retracting a bit. When the candlestick eventually closes, it leaves a little shadow at that end, making it an Opening Bozu.

The Bullish Belt Hold Line Pattern

The bullish version of the Belt Hold Line pattern must appear in an existing downtrend, where it gaps down on open to open below the previous candlestick. However, it rallies to closes the falling window (fills the gap) and penetrates the real body of the previous candlestick before falling back to close with a little shadow at the top of the candlestick.

What the Bullish Belt Hold Line Pattern tells us

The bullish Belt Hold Line pattern is similar to the bullish Counter Attack pattern in psychology. Firstly, it must occur at a low-price level in an established downtrend for it to be of significance. it the broader downtrend, the bears are in control or the market. This strength is further implied when the Belt Hold Line candlestick opens as it gaps down on open in the direction of the downtrend. However, the Belt Hold Line soon turns bullish, closing the gap and closes near its high. This has serious bullish implications, with the length of the Belt Hold Line reflecting the extent of the strength of the bulls and implies a shift in market sentiment, with the possibility of a transition to a bullish trend reversal. The Belt Hold Line pattern becomes more significant depending on the size of candlestick in this pattern.

Trading the Bullish Belt Hold Line Pattern

The bullish Belt Hold Line is a mild trend reversal pattern that warns that there is some weakness in the downtrend that could lead to the end of the downtrend and a possible transition to a bullish uptrend. Traders that are currently holding short positions should be looking to cover their short positions. However, as bullish Belt Hold Line pattern is a mild trend reversal signal, it requires a bullish confirmation candlestick before a long position should be taken. This confirmation could be in the form of a close above the real body of the Belt Hold Line candlestick, though a close above the real body of the candlestick that preceded the Belt Hold Line would be a better confirmation. Once confirmation has been obtained, the trader may initiate a long position on the opening of the next candlestick.

As a long position would be taken against the current downtrend, a protective stop-loss order should be used to limit the risk of the pattern failing. This protective stop could be placed just below the low of the bullish Belt Hold Line candlestick as a price break below this level would negate the pattern. If the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible retracement back towards the potential support area represented by the low of the Belt Hold Line candlestick. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a retracement will take place. Remember that confirmation of the pattern must still be obtained before a buy order is placed.

The bullish Belt Hold Line pattern does not provide a clear profit target; therefore, other trading mechanisms or methods, such as a measured moved defined by an acceptable risk/reward ratio, a key Fibonacci retracement level, the appearance of a bearish candlestick formation, or a simple trailing stop, could be used to exit the long position.

As with most trend reversal patterns, the bullish Belt Hold Line pattern becomes more reliable when it appears near a trendline, a pivot point, or a support and resistance line, etc. A bullish Belt Hold Line hat forms at or near a lower trendline or a support line can be used in anticipation that the test of the trendline or support line is not likely to break it. As a result, the price should be expected to climb, giving greater impetus to the pattern. Also, if the bullish Belt Hold Line pattern is formed at a low-price level or in an extended downtrend, it becomes more significant as the market could be in an oversold condition. Here traders can use the bullish Belt Hold Line pattern in conjunction with an oscillating indicator, such as the RSI, to confirm that the security is oversold.

The Bearish Belt Hold Line Pattern

The bearish Belt Hold Line pattern is the opposite of its bullish counterpart. The bearish Belt Hold Line candlestick must appear in an established uptrend, where it should gap up on open to open above the real body of previous candlestick. However, the Belt Hold Line should decline fairly abruptly to close the window (fill the gap) and possibly penetrate the real body of the previous candlestick before rising a bit to eventually close with a little shadow at the bottom of the candlestick.

What the Bearish Belt Hold Line Pattern tells us

The bearish Belt Hold Line pattern must occur in an established uptrend, preferably at a high-price level, before it is taken into consideration. Here the bearish Belt Hold Line pattern implies the same market psychology as the bearish Counter Attack pattern. Its appearance occurs in a broader uptrend where the bulls are in control or the market. This bullish strength is further implied when the Belt Hold Line candlestick opens as it gaps up on open above the real body of the previous candlestick. However, the Belt Hold Line soon turns bearish by closing the gap and closes near its the low for that session. This has serious bearish implications, with the length of the Belt Hold Line reflecting the extent of the strength of the bears and implies a shift in market sentiment, which could lead to a transition to a bearish trend reversal. As with the bullish Belt Hold Line pattern, the significance of bearish Belt Hold Line pattern is proportional to the size of the Belt Hold Line candlestick.

Trading the Bearish Belt Hold Line Pattern

Trading the bearish Belt Hold Line pattern is the inverse of trading the bullish Belt Hold Line pattern. Here, some weakness in an existing uptrend and a possible transition to a trend reversal is implied. This suggests that the bullish uptrend could be coming to an end. Traders with open long positions should, therefore, look for opportunities to exit their short positions and then prepare to go long. However, as with the bullish Belt Hold Line pattern, the bearish Belt Hold Line is a mild trend reversal pattern that requires confirmation. This confirmation could be in the form of a close below the real body the candlestick that preceded the Belt Hold Line. Once the pattern has been confirmed, the trader could place a sell order on the open of the next candlestick.

Since a short position would be taken against the current trend, a protective stop-loss order should be used to limit the risk of the pattern failing. This protective stop could be placed just above the top of the Belt Hold Line candlestick as a price break above this level would negate the pattern. If the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the potential resistance area represented by the high of the Belt Hold Line. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur. Remember that confirmation of the pattern must first be obtained before placing a sell order.

The Belt Hold Line pattern does not provide a clear profit target. Instead, a trader could implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

As with most trend reversal patterns, the bearish Belt Hold Line pattern becomes more reliable depending on where it appears on the price chart in relation to trendlines, pivot points, and support and resistance lines, etc. An Belt Hold Line pattern at or near an upper trendline or resistance line can be used in anticipation that the test of the trendline or resistance line is not likely to break it. The resulting price decline following the failure to break the trendline or resistance line should give greater impetus to the pattern. Also, if the bearish Belt Hold Line pattern is formed at an all-time high, it becomes more significant as the market could be overbought. Here traders can use the bearish Belt Hold Line pattern in conjunction with an oscillating indicator, such as the RSI, that shows the security to be overbought.