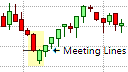

The Meeting Lines or Counterattack Lines Pattern

What is the Meeting Lines Pattern?

The Meeting Lines Pattern

The Meeting Lines pattern, which is also called the Counterattack Lines pattern, or deai sen, which means "lines that meet" in Japanese, is a double candlestick pattern trend reversal pattern that is similar to the Piercing Line and the Dark Cloud Cover patterns in that it consists of two candlesticks of alternating colors that have relatively large real bodies and initially gaps away from each other. The defining difference being that the two candlesticks that form the Meeting Lines pattern have the same, or nearly the same, close, where as in the Piercing Line and the Dark Cloud Cover patterns, the second candlestick closes within the real body of the previous candlestick. The failure of the Meeting Lines pattern to penetrate the real body of the previous candlestick means that it is less reliable than the Piercing Line and the Dark Cloud Cover patterns.

The bullish Meeting Lines pattern is also similar to the In-Neck pattern in that it consists of two candlesticks of alternating colors that initially gaps away from each other but have more or less the same closing price, though the In-Neck pattern is a bearish trend continuation pattern.

The Meeting Lines candlestick pattern can also be a bullish reversal pattern if it appears in an established downtrend or a bearish reversal pattern if it appears in an established uptrend. In both cases, the first candlestick moves in the direction of the trend while the second moves against the trend.

The Meeting Lines Formation

The Meeting Lines pattern can appear in an established trend and consists of two candlesticks. The first candlestick in the pattern is a relatively large candlestick that is supportive of the current trend. The second candlestick in the formation is also a relatively large candlestick that gaps well away from the real body of the first candlestick but then turns back to close at the same level as the previous candlestick in the pattern. The result is two large candlesticks of alternating colors with the same or almost the same closing price.