The In-Neck Candlestick Pattern

What is the In-Neck Pattern?

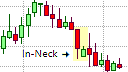

The In-Neck Pattern

The In-Neck candlestick pattern is a bearish trend continuation pattern that is similar in formation to the Piercing Line pattern. Like the Piercing Line pattern, the In-Neck candlestick pattern is a double candlestick pattern but, while the second candlestick in the Piercing Line pattern penetrates deep into the real body of the first candlestick, in the In-Neck pattern, the second candlestick fails to penetrate the real body of the first candlestick. For this reason, the Piercing Line pattern is considered a trend reversal pattern while the In-Neck pattern is considered a trend continuation pattern.

The In-Neck pattern is also related to the On-Neck pattern, and the Trusting Line pattern that have the same general formation but differ in where the second candlestick closes in relation to the previous candlestick.

As the In-Neck pattern is a bearish trend continuation pattern, it should appear in an established downtrend to be of any real significance.

The In-Neck Formation

The In-Neck pattern consists of two candlesticks with alternating colors. The first candlestick must be supportive of the current downtrend. Thus, it must be a black or dark-colored candlestick with a large real body. The second candlestick then gaps down and away from the real body of the previous candlestick to open below the low of the previous candlestick. This candlestick then reverses direction, becoming a bullish candlestick that closes at, or very close to the bottom of the previous candlestick's real body, i.e., at or near the close of the previous candlestick. If the second candlestick does not close very near to the previous candlestick's close but at or near the low of previous candlestick's lower shadow, then the formation becomes an On-Neck pattern.

What the In-Neck Pattern tells us

The first candlestick in the In-Neck pattern is strong, bearish candlestick that indicates that the current downtrend is still going strong. The second candlestick then gap down at the open to below the real body the previous candlestick, reinforcing the notion that the downtrend is still strong. However, this candlestick then reverses direction and closes very near the close of the first candlestick indicating a mild correction in the downtrend as the bullish candlestick is weak. This weakness is indicated by the relative short size of the second candlestick, and its failure to close above the previous candlestick's close. As a result, the down trend can be expected to continue.

Trading the In-Neck Pattern

As with the On-Neck pattern, the In-Neck pattern is an opportunity for the trader to either enter a short position if they are not already short, or to add to an existing short position. However, opening or adding to a short position would require confirmation first. This confirmation would be in the form of a close below the low of the second candlestick in the pattern. When entering a new position, a protective stop-loss should be placed just above the high of the first candlestick as a price movement above the pattern indicates that the correction might be extended or that there is weakness in the downtrend.

The In-Neck pattern also represents an opportunity for a trader that has an existing short position to move their protective stop-loss to just above the high of the first candlestick. tis may allow them to lock in some profits.

As with most other trend continuation patterns, the In-Neck pattern becomes more reliable if it at an upper trend line or a resistance line on the price chart, where it could indicate that these levels have held. Traders can use the In-Neck pattern in conjunction with an oscillating indicator, such as the RSI.