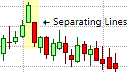

The Separating Lines Candlestick Pattern

What is the Separating Lines Pattern?

The Separating Lines Pattern

The Separating Lines candlestick pattern is a dual candlestick pattern that consists of two candlesticks of alternating colors. It is similar to the Meeting Lines or Counter Attack pattern in formation but the Separating Lines pattern is classified as a trend continuation pattern. The Separating Lines pattern can be either bullish or bearish, depending on the nature of the trend that it occurs in.

The distinguishing feature of the Separating Lines pattern is that the two candlesticks that comprise the pattern have the exact same opening price level or a very close opening price level but have alternating colors. The former also differentiates the Separating Lines pattern from the Meeting Lines or Counter Attack pattern as the two candlesticks in the Meeting Lines pattern have the same closing price level.

The Separating Lines Formation

The Separating Lines pattern should appear in an existing trend for it to be of significance. The first candlestick in this pattern represents a small pullback against the current trend. However, the second candlestick in the pattern totally disregards this pullback by gapping on open to open at the same price, or very close to the same price level, as the previous candlestick. The second candlestick then moves in the direction of the current trend leaving it with no shadow at the end at which it opened.

The Bullish Separating Lines Formation

The bullish Separating Lines pattern is a bullish trend continuation pattern that should appear in an existing uptrend for it to be of significance. The first candlestick in this pattern is a bearish candlestick that is dark in color and moves against the current trend. This candlestick represents a small pullback in the current trend. However, the second candlestick in the pattern totally disregards this pullback by gapping up to open at the same price, or very close to it, as the previous candlestick. The second candlestick then proceeds to close even higher giving it no lower shadow or a shaven bottom.

What the Bullish Separating Lines Pattern tells us

Psychologically, the first bearish candlestick occurs with the market slightly overbought. This bearish candlestick gives the bulls something to ponder as it indicates a possible weakening of the uptrend. However, the bullish negation of the pullback suggests that it was just a minor consolidation, giving the bulls renewed confidence that the trend still has momentum. Not only have the bears failed to drive the market further down, but the gap up on the second candlestick all but negated the gains the bears made on the first candlestick. In addition, the size of the second candlestick indicates that the bulls have regained control of the market. Bears that took a short position against the prevailing uptrend on the first candlestick in the pattern are now under pressure to close their positions, meanwhile, the bulls will have renewed confidence in their long positions. With this renewed confidence, the trend is more likely to continue than reverse.

Trading the Bullish Separating Lines Pattern

The bullish Separating Lines pattern is a bullish continuation pattern that appears in an uptrend and suggests that the uptrend is more likely to continue than reverse. Traders that have existing long positions would want to hold their long positions, and possibly add to it. Traders that missed earlier opportunities to enter the market could use the bullish Separating Lines pattern to enter the market. However, opening or adding to a long position would require confirmation of the pattern in the form of a close above the high of the second candlestick in the pattern. When entering a new position, a protective stop-loss should be placed just below the low of the first candlestick as a price movement below the pattern indicates that the consolidation might be extended or that there is a greater weakness in the uptrend. If the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible retracement back towards the low of the Separating Lines pattern. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a retracement will take place. The Separating Lines pattern also represents an opportunity for a trader that has an existing long position to rack up their protective stop-loss to just below the low of the Separating Lines pattern, allowing them to potentially lock in some profit.

The bullish Separating Lines pattern does not provide a clear profit target; therefore, other trading mechanisms or methods, such as a previous support or resistance area, a measured moved defined by an acceptable risk/reward ratio, a key Fibonacci extension level, the appearance of a bearish candlestick formation, or a simple trailing stop.

As with most other trend continuation patterns, the Separating Lines pattern becomes more reliable if it at an upper trendline or a resistance line on the price chart, where it could indicate that these levels have failed. Traders can also use the Separating Lines pattern in conjunction with an oscillating indicator, such as the RSI.

The Bearish Separating Lines Formation

The bearish Separating Lines pattern is the opposite of its bullish counterpart. It is a bearish trend continuation pattern that should appear in an established downtrend. The first candlestick in the bearish version of the Separating Lines pattern is a bullish candlestick that is light in color and moves against the downtrend. This candlestick represents a small or minor correction in the downtrend. However, the next candlestick in the pattern totally disregards this correction and gaps down to open at the same price level that the previous candlestick had opened. The second candlestick then turns bearish immediately and closes even lower with no upper shadow or a shaven head.

What the Bearish Separating Lines Pattern tells us

The psychology is similar too, with the first bullish candlestick appearing with the market somewhat oversold and in need of a correction. This bullish candlestick gives the bears some concern as it moves against the downtrend, indicating that there is some weakness in the trend. However, the second candlestick gives the bears renewed confidence that the downtrend still has strength. Firstly, it gaps down to open at the same level that the previous candlestick had opened; negating the gains of that session. Secondly, the size of the second candlestick indicates that the bears have regained control of the market. Bulls that bought against the prevailing downtrend on the first candlestick in the pattern are now under pressure to cover their long positions, meanwhile, the bears will have more confidence in their short positions. As a result, the downtrend is more likely to continue rather than it transitioning into an uptrend.

Trading the Bearish Separating Lines Pattern

The bearish Separating Lines pattern is a continuation pattern that appears in a downtrend and suggests that the trend will probably continue after the pattern has completed. Traders that have existing short positions would want to hold on their short positions, and possibly add to it. For traders that missed earlier opportunities to enter the market, the bearish Separating Lines pattern represents an opportunity to enter the market. However, opening or adding to a short position should only be done once that bearish Separating Lines patter has been confirmed. This confirmation could be in the form of a close below the low of the second candlestick in the pattern. When entering a new position, a protective stop-loss should be placed just above the high of the first candlestick as a price movement above this level would indicate that the correction might not be over or that there is a deeper-seated weakness in the downtrend. If the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the high of the Separating Lines pattern. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a retracement will take place. The Separating Lines pattern also represents an opportunity for a trader that has an existing long position to move their protective stop-loss to just below the low of the first candlestick, allowing them to potentially lock in some profit.

The bearish Separating Lines pattern also does not provide a clear profit target; therefore, other trading mechanisms or methods, such as a previous support or resistance area, a measured moved defined by an acceptable risk/reward ratio, a key Fibonacci extension level, the appearance of a bullish candlestick formation, or a simple trailing stop.

As with most other trend continuation patterns, the Separating Lines pattern becomes more reliable if it at an upper trendline or a resistance line on the price chart, where it could indicate that these levels have failed. Traders can also use the Separating Lines pattern in conjunction with an oscillating indicator, such as the RSI.