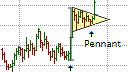

The Pennant Pattern

The Pennant Pattern

The Pennant pattern is a short-term continuation pattern that marks the mid-point of a longer trend movement. It is similar to the flag pattern with the consolidation period forming a small triangle rather than a parallelogram or a rectangle. The Pennant is the consolidation phase that forms after a rapid, near vertical movement, and is usually characterized by a decrease in volumes. The consolidation period formed by profit taking by traders that entered before the sharp movement, and traders who missed the initial movement and see this phase as a opportunity to enter the trade. The formation of the Pennant pattern coincides with a decline in volumes until the break out, which usually occurs within 15-20 bars.

Entry Signal

The consolidation period in the Pennant pattern forms a small triangle, as with other triangle patterns, an entry signal is given when the price breaks out of the little triangle, in the direction of the preceding sharp price movement. The break out is usually accompanied by an increase in volume. If the volume does not increase then the risk of a failure is much greater.

Price Projection

The price projection for the Pennant pattern is a little complicated. Most traders use the length of the sharp movement that preceded the Pennant as the minimum price target. As with all other chart patterns, you should also consider the overall support and resistance levels on the chart to determine levels areas of potential weakness at which to consider taking at least partial profits.