The Inverted Hammer Candlestick Pattern

What is the Inverted Hammer Pattern?

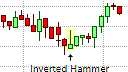

The Inverted Hammer Pattern

The Inverted Hammer pattern is a bullish trend reversal pattern that has the same form as a Shooting Star. The Inverted Hammer pattern consists of a single candlestick, and is also similar to the Hammer pattern in that it is a bullish signal that consists of an umbrella line and appears in a downtrend and warns of a possible trend reversal. Though in the Hammer pattern, the umbrella line is not inverted.

The Inverted Hammer Formation

The Inverted Hammer pattern consists of a single candlestick that is called an inverted umbrella line. An inverted umbrella line has the shape of an open umbrella resting on the floor. This candlestick has a short real body that is located at the lower end of the price range, and very little or no lower shadow, and a long upper shadow, which must be at least twice the length of the real body. As with the Hammer and the Hanging Man patterns, the color of the Inverted Hammer pattern's real body is not important, instead its size, in relation to its shadows are. The real body must be short and must be located at or very near the bottom of the price range. In other words, it must have very little or no lower shadow otherwise the close would not be near the bottom of the range and the candlestick would take the form of a Spinning Top rather than an Inverted Hammer. The upper shadow is also important and must be at least two or three times the length of the real body.

What the Inverted Hammer Pattern tells us

In essence, the Inverted Hammer pattern is the bullish version of the moderate Hanging Man reversal pattern.

The long upper shadow of the Inverted Hammer pattern is a bearish signal regardless of the color of the candlestick's real body. It indicates that the underlying instrument rallied strongly during the session but then sold of later in the session, forcing the price back down to close at or near the low for that session. While this has bearish implications, it also indicates that the downtrend is weakening as the price was pushed up considerably before coming back down again. This candlestick is an early indicator of the emergence of demand for the underlying that could drive the price up. This could potentially mark the start of a new uptrend though a reversal is still tentative and would require some sort of confirmation before being acted upon.

Trading the Inverted Hammer Pattern

As mentioned earlier, the long upper shadow of the Inverted Hammer is generally a bearish signal, indicating that initial demand for the underlying security was overcome by a later sell-off that forced the price to close at the lower end of the price range for that session. And as the Inverted Hammer pattern is a potential bullish signal, confirmation of the weakness in the downtrend, in the form of another bullish candlestick pattern, such as a bullish Engulfing pattern, or a close above the real body of the Inverted Hammer would be recommended.

Alternatively, the Inverted Hammer pattern could be used to close an existing short position rather than entering a new long position. After the Inverted Hammer has completed, a subsequent close above the real body of the Inverted Hammer would indicate that a bullish reversal is more probable and traders could consider closing their short positions. In the short term, following the Inverted Hammer pattern, traders could watch out for the appearance of a bullish candlestick pattern, such as the Morning Star, or the Three White Soldiers pattern, as these could herald the start of a up and could be used to enter a long position.

The bullishness of the Inverted Hammer pattern would be more significant should it occur in an extended and strong downtrend.

The Inverted Hammer pattern also does not provide a profit target. Instead, some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bearish candlestick formation, or a simple trailing stop.