The Hammer Candlestick Pattern

What is the Hammer Pattern?

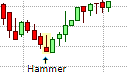

The Hammer Pattern

The Japanese name for the Hammer pattern is takuri, which means testing the water for its depth. The Hammer pattern is a single candlestick pattern that is identical in appearance to the Hanging Man pattern, but it can occur in a downtrend. The Hammer pattern is a bullish trend reversal signal that warns of a possible trend reversal to the upside. The candlestick is called a Hammer because it is said to hammer out a base at the bottom of the downtrend that would support a subsequent uptrend.

The Hammer pattern also has a counterpart called the Inverted Hammer that also appears in a down trend but has a long upper shadow rather than a long lower shadow.

The Hammer Formation

The Hammer pattern consists of a single candlestick that is called an umbrella line because of its form or shape. An umbrella line has the shape of an open umbrella with a short real body located at the upper end of the price range, and very little or no upper shadow, and a long lower shadow, which is at least twice the length of the real body. The color of the Hammer pattern's real body is not important, instead its size, in relation to its shadows are. The real body must be short and must be located at or very near the top of the price range. In other words, it must have very little or no upper shadow otherwise the close would not be near the top of the range and the candlestick would take the form of a Spinning Top rather than a Hammer. The lower shadow is also important and must be at least two or three times the length of the real body.

What the Hammer Pattern tells us

The long lower shadow of the Hammer pattern is a bullish signal regardless of the color of the candlestick's real body. It indicates that the underlying instrument sold off sharply during the session but demand returned, forcing the price back up to close at or near the high for that period. This has bullish implications with the lower shadow becoming a potential support area. The longer the lower shadow, the more significant the reversal signal becomes.

Trading the Hammer Pattern

The Hammer Pattern is a bullish trend reversal pattern that warns of increasing weakness in an existing downtrend and the probable end of the downtrend. Traders with open short positions should be looking to cover their short positions on the open of the candlestick that follows the Hammer formation, and will be looking to go long, which means they will be preparing to place buy orders. The bullish nature of the Hammer pattern is significant in a downtrend and therefore does not require confirmation. As such, a trader could look to take a long (buy) position on the open of the next candlestick. A logical place for a stop loss would be below the low of the Hammer's lower shadow, which could be a support area. Should the price move below this level it would break the potential support area at the low of the Hammer's lower shadow and would invalidate the Hammer pattern.

However, the length of the lower shadow may not provide a favorable risk/reward for the trade given its distance from the protective stop loss. If this risk is too great, a trader could wait for a possible correction into the area of the Hammer's lower shadow before taking a long position. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade. It would also be close to the potential support area at the low of the Hammer's lower shadow. However, a correction towards the Hammer's lower shadow might not occur.

The bullish Hammer pattern does not provide a profit target but a trader could implement a profit target based on a measured moved defined by an acceptable risk/reward ratio or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bearish candlestick formation, or a simple trailing stop.

The bullish Hammer pattern is more reliable when the Hammer's lower shadow is longer, and when its real body is smaller. It is also more reliable if it forms at a low-price level in an extended downtrend. The Hammer pattern is, however, less reliable if there were a number of Hammer candlesticks that formed during the downtrend.