Reading Candlestick Charts

Candlestick Chart

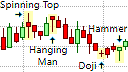

Candlesticks are good indicators of market psychology, i.e., the emotions of fear and greed experienced by the buyers and sellers, and the strength of those emotions. This indication is based on the size, color, and location of the candlestick. The color of the candlestick indicates whether bullish or bearish sentiment dominated, with a white or light-colored candlestick indicating that the bulls are in control while a black or dark-colored candlestick indicates that the bears are in control. The only time that the color of the candlestick is not important is when the candlestick is what is called an umbrella line or an inverted umbrella line. These are candlesticks that have a relatively short real body with little or no shadow on the one side and a long shadow on the other side. Examples of umbrella and inverted umbrella lines are: the Hanging Man, the Hammer, the Inverted Hammer, and the Shooting Star.

Size and Color

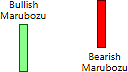

Marubozu Lines

A white or light-colored, bullish candlestick with no shadows is called a Marubozu and indicate strong bullishness; with the longer the Marubozu candlestick the stronger the bullishness. These candlesticks indicate that the price moved strongly in a predominant direction with little resistance to this movement. A bullish candlestick with a relatively long lower shadow, a relatively small real body and a short or no upper shadow indicates that the buyers were able to drive the price up from the low. This is also a strong bullish candlestick. However, a bullish candlestick with a relatively long upper shadow, a relatively small real body and a short lower shadow indicates that sellers were able to drive the price down from the high but were not able to defeat the buyers. Although this candlestick is bullish, it is weak; and the longer the upper shadow and the smaller the real body, the weaker the candlestick.

A short candlestick with a relatively short real body indicates a lack of real commitment from both the buyers and the seller. The market is in equilibrium with the price not moving significantly in either direction. When a small candlestick appears in an established trend, it is an early indication of weakness in the trend as it shows that the forces driving the trend are beginning to dissipate. A series of increasingly shorter candlesticks in the direction of the trend is also an early sign of a weakening of the trend.

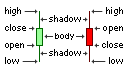

Length and Location of Shadows

Candlestick Formation

The shadows or wicks of the candlestick also indicate bullishness or bearishness, with long lower shadows being bullish and long upper shadows being bearish. The long lower shadow indicates that the underlying instrument sold off sharply during the session but then demand returned, forcing the price to bounce back up to close significantly off the low for that period. This is a bullish signal that becomes stronger when the lower shadow is longer. Conversely for the long upper shadow, which indicates that the underlying instrument rallied strongly during the session but then sold-off sharply to close well off of the high for that period. This has bearish implications that becomes stronger when the upper shadow is longer.

Some candlesticks may have relatively long shadows at both ends, making it a Spinning Top, or a Long-Legged Doji, depending on the length of the candlestick's real body. Here the long shadows would negate each other and would convey a moment of indecision.

Location on the Chart

Candlesticks Chart

A series of light-colored candlesticks with expanding real bodies may appear bullish but its location (where it appears on the chart) may convey caution. Obviously, strong bullish candlesticks on a downtrend indicate an upsurge in demand which will result in a trend reversal. A series of strong, bullish candlesticks early in the development of an uptrend would indicate that the uptrend is still strong and will not be ending anytime soon as it is gaining in momentum. However, a series of light-colored candlesticks with expanding real bodies in an extended uptrend might be an early warning that the uptrend is nearing an end. In an extended uptrend, bullish candlesticks with large real bodies that are expanding in size may indicate panic and a rush by traders to liquidate their short positions rather than continuing demand. Traders who held on to their short positions in the hope that the uptrend would eventually reverse may have begun to panic as the uptrend extended longer that they could hold their nerve. As these traders rush to cover their short positions, they would push the price up without there being real demand for the underlying security.