The Upside Gap Two Crows

What is the Upside Gap Two Crows Pattern?

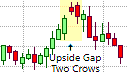

The Upside Gap Two Crows Pattern

The Upside Gap Two Crows candlestick pattern is a rare candlestick pattern that is similar to the Evening Star candlestick pattern and the Engulfing candlestick pattern, but with a few significant differences. Like the Evening Star pattern, the Upside Gap Two Crows pattern is a bearish top reversal pattern that consists of three candlesticks and can appear in an established uptrend where it warns of a possible trend reversal.

The Upside Gap Two Crows Formation

The Upside Gap Two Crows pattern is a triple candlestick pattern that must appear in an established uptrend for it to be taken into consideration. The first candlestick in the pattern must be a bullish, light-colored candlestick with a large real body. This bullish candlestick is followed by two smaller bearish candlesticks that almost takes the form of the Engulfing pattern, except that they are both bearish candlesticks that are dark in color whereas in the Engulfing pattern they must be of alternating colors. The first bearish candlestick that follows the bullish candlestick should be a small bearish candlestick that has an upside gap between its real body and the real body of the previous candlestick, as is the case with the Evening Star pattern. The third and last candlestick in the pattern should gap up on open to open above the real body of the middle candlestick. However, it should close below the previous candlestick's real body and completely engulf its real body. The last candlestick may close the window below the second candlestick and may penetrate the real body of the first candlestick. Where the upside-gap two crows pattern differs from the Evening Star pattern is in the last candlestick, which need not penetrate and close well into the real body of the first candlestick.

What the Upside Gap Two Crows Pattern tells us

The Upside Gap Two Crows pattern forms in an established uptrend where the bulls are in control of the market. The first candlestick in the pattern illustrates the continued bullish strength with the large size of the candlestick's real body reflecting the extent of that strength. This strength is implied on the open of the second candlestick that gaps up from the first candlestick. However, this candlestick soon shows weakness in the trend as it turns bearish and closes below its open, making it a bearish candlestick. As this is a relatively small candlestick with a short real body, it does not imply that the bears are in the ascendancy but indicates that there is weakness in the uptrend.

The third candlestick in the pattern again reflects a bullish open as it gaps up on open to open above the real body of the second candlestick. However, the candlestick turns bearish and encloses the real body of the previous candlestick when it closes. This has much greater bearish implications, especially if the third candlestick closes the window below the second candlestick and penetrates the real body of the first candlestick. This candlestick implies an increase in strength among the bears and increases the possibility of a transition to a bearish trend reversal.

Trading the Upside Gap Two Crows

The Upside Gap Two Crows pattern forewarns of a possible reversal in the trend, which means a bearish downtrend should be anticipated. This calls for short selling. If the last candlestick in the Upside Gap Two Crows formation closes below the midpoint of the first candlestick's real body, the trader may initiate a short position on the opening of the next candlestick. However, if the last candlestick does not penetrate the real body of the first candlestick, it means the window below the second candlestick is still open. Remember that a rising window becomes a support area. The trader should, therefore, wait for confirmation of the reversal. This confirmation could be in the form of a subsequent candlestick closing the rising window. The trader can then place a short sell order on open of the next candlestick.

Since a short position would be taken against the current trend, a protective stop-loss order should be used to limit the risk of the pattern failing. This protective stop-order could be places just above the high of the Upside Gap Two Crows pattern as a break above this level would negate the pattern. However, if the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the potential resistance area represented the high of the pattern before entering the trade. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur.

The Upside Gap Two Crows pattern does not provide a clear profit target. Instead, a trader could implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

The Upside Gap Two Crows pattern is more significant the deeper last candlestick penetrates the first candlestick in the pattern. It also becomes more significant depending on where it appears on the price chart in relation to trend lines, pivot points, and support and resistance lines, etc. An Upside Gap Two Crows pattern at or near an upper trendline or resistance line can be used in anticipation that the test of the trendline or resistance line is not likely to break it. The resulting price decline following the failure to break the trendline or resistance line should give greater impetus to the pattern. Also, if the Upside Gap Two Crows Top pattern is formed at an all-time high, it becomes more significant as the market could be overbought. Here traders can use the Upside Gap Two Crows Top pattern in conjunction with an oscillating indicator, such as the RSI, that shows the security to be overbought.