Triple Candlestick Patterns

Now that we've covered Single Candlestick Patterns and Double Candlestick Patterns, it is time to move on to Triple Candlestick Patterns.

What are Triple Candlestick Patterns?

Triple candlestick patterns are candlestick patterns that consists of three candlesticks. They can be classified as trend reversal patterns or as trend continuation patterns, though there are far more double candlestick reversal patterns than double candlestick continuation patterns, and they can be bullish or bearish. Sometimes a triple candlestick pattern can include a single candlestick pattern or a double candlestick pattern.

As with all other candlestick patterns, triple candlestick patterns should only be taken into consideration if they appear in an exiting trend. If they form in a non-trending market, they can safely be ignored.

Common Triple Candlestick Patterns

The most common triple candlestick patterns are Star patterns that consist of three candlesticks. These are the Morning Star and Morning Doji Star patterns, the Evening Star and Evening Doji Star patterns, the Shooting Star pattern, and the Tri-Star pattern. These patterns are covered in our next lesson on Star patterns.

The Three Advancing White Soldiers pattern

The Three Advancing White Soldiers pattern is a moderate bullish trend reversal pattern that can appear in an existing downtrend where it indicates a weakening of the downtrend and the possible transition to an uptrend. This pattern is called the Three Advancing White Soldiers pattern because it consists of three relatively long bullish (hence advancing) candlesticks that are light in color. Each of the three candlesticks should close against the prevailing trend on or near the high price for the period, and each candlestick must mark a steady advance in the price movement. Preferably, each candlestick should not have long upper shadows and should open within the real body of the preceding candlestick in the pattern, though the latter is not essential. The pattern's successive higher highs and higher lows made in a downtrend suggests that the bulls are increasing in strength and are beginning to overpower the bears.

Further Reading

- The Three Advancing White Soldiers Pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trend Lines in Chart Patterns

The Three Black Crows pattern

The Three Black Crows pattern is the bearish counterpart to the Three Advancing White Soldiers pattern. It can appear in an existing uptrend where it indicates increasing weakness in the uptrend and the possible transition to a downtrend. The Three Black Crows consists of three relatively long bearish candlesticks that are black or dark in color, giving it the appearance of three black crows peering down ominously from the tree tops. Each of the three candlesticks in the pattern should close against the prevailing downtrend on or near the low price for the period and each candlestick must mark a steady decline in the price movement. Each candlestick should not have long lower shadows and should preferably open within the real body of the preceding candlestick in the pattern, though the latter is not essential. The pattern's successive lower lows and lower highs made in an uptrend suggests that the bears are increasingly overpowering the bulls.

Further Reading

- The Three Black Crows Pattern in Candlestick Patterns

- The Three Advancing White Soldiers Pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trend Lines in Chart Patterns

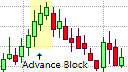

The Advance Block pattern

The Advance Block pattern is another moderate bearish trend reversal pattern that can form during an uptrend. Its formation is similar to the bullish Three Advancing White Soldiers pattern in that it consists of three successive bullish candlesticks that have successive higher highs and higher lows but are also increasingly smaller in size with increasingly longer upper shadows. This pattern indicates that the current trend is weakening, which can be seen in the successively shorter real bodies of each candlestick and the longer shadows on the last two candlesticks. This points to a potential end to a rally and the possible emergence of a downtrend, though it can also be the start of a short consolidation phase.

Further Reading

- The Advance Block Pattern in Candlestick Patterns

- The Three Advancing White Soldiers Pattern in Candlestick Patterns

- The Trend Reversal Patterns in Candlestick Patterns

- The Trend Lines in Chart Patterns

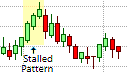

The Stalled or Deliberation pattern

The Stalled pattern, which is also referred to as the deliberation candlestick pattern, is a similar looking bearish trend reversal pattern. The Stalled pattern can appear in an established uptrend where it usually indicates a weakening of the existing trend, and the possible transition to a bearish downtrend. It also consists of three bullish candlesticks that make successive higher highs and higher lows but each successive candlestick also has a progressively shorter real body. The Stalled pattern differs in that its first two candlesticks must have shortish shadows while its last candlestick must have a relatively long upper shadow and a relatively short real body. The market is said to be pausing to deliberate on its next move.