The Tweezer Top and Tweezer Bottom Patterns

What is the Tweezer Pattern?

Tweezer Top and Tweezer Bottom

The Tweezer candlestick pattern is a minor trend reversal pattern that consists of two candlesticks with the exact same or almost the same high, or the exact same or almost the same low. It is the only candlestick pattern where the highs or lows are the most important factor rather than the real body or the shape of the candlesticks. In addition, the two candlesticks should have alternating colors with the first confirming the current trend and the second reversing direction and indicating weakness in the trend. The pattern is more reliable when the first candlestick is has a relatively large real body while the second candlestick has a relatively short real body. It is also more reliable when the Tweezer pattern forms or includes a second reversal pattern, such as an Engulfing pattern or a Piercing Line pattern with identical highs or lows. If the Tweezer pattern appears in an uptrend and has the same highs, it is called the Tweezer Top pattern; and if it appears in a downtrend and has the same lows, it is called the Tweezer Bottom pattern.

The Tweezer Formation

The Tweezer pattern is a double candlestick pattern that should appear in an existing trend. The two candlesticks in this pattern should have close to the exact same high-price level if it appears in an uptrend or close to the exact same low-price level if it appears in a downtrend.

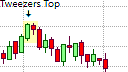

The Tweezer Top Formation

The Tweezer Top pattern appears in an uptrend. The first candlestick in this pattern should be a bullish candlestick with a relatively large real body followed by a bearish candlestick with a relatively short real body, or a Doji. The important requirement is that the two candlesticks must have the exact same high or the second candlestick's high must be just below that of the first candlestick. The highs can be the top of the upper shadow or the top of the real body if that candlestick does not have an upper shadow.

What the Tweezer Top Pattern tells us

The first candlestick in the bearish Tweezer Top pattern indicates that the current uptrend is still strong with the length of its real body illustrative of the extent of that strength. However, the relative size of the second candlestick shows weakness in the trend as it has a much smaller real body and is often a bearish candlestick that was not able to break above the previous candlestick's high. This indicates that the strength shown on the first candlestick has dissipated and, as such, it has bearish implications.

Trading the Tweezer Top Pattern

The Tweezer Top pattern is a minor trend reversal pattern and does not necessarily indicate the immediate transition to a downtrend. As such, the Tweezer pattern should be used more to protect an existing long position rather than entering a short position. After the Tweezer has completed, a subsequent price movement below the first candlestick’s real body could indicate that a bearish reversal is possible. In the short to medium term, following the Tweezer Top pattern, the trader should watch out for the appearance of another bearish candlestick pattern, such as the Three Black Crows, the Advance Block, or the bearish Engulfing pattern, as these could mark the start of a downtrend and could be used to enter a short position.

The Tweezer Bottom Formation

The Tweezer Bottom pattern is the opposite of the Tweezer Top and could appear near the end of a downtrend. Here the first candlestick must be a dark, bearish candlestick with a large real body, followed by a bullish, light-colored candlestick with a short real body. The second candlestick can also be a Doji. The two candlesticks must have either the exact same low or their lows should be very close together. The lows of the two candlesticks are an important defining characteristic in the Tweezer Bottom formation. The lows can be the bottom of the lower shadow or the bottom of the real body if that candlestick does not have a lower shadow.

What the Tweezer Bottom Pattern tells us

The first candlestick in the Tweezer Bottom pattern indicates that the current downtrend is still has strength, with the length of its real body illustrative of the extent of this strength. However, the relative size of the second candlestick shows weakness in the trend as it has a much smaller real body and is often a bullish candlestick that was not able to break below the previous candlestick's low. This indicates that the strength shown on the first candlestick has dissipated fairly quickly and, as such, the Tweezer Bottom has bullish implications.

Trading the Tweezer Bottom Pattern

As with the Tweezer Top pattern, the Tweezer Bottom pattern is a minor trend reversal pattern and will not necessarily lead to the immediate transition to an uptrend. As such, the Tweezer pattern should be used more to protect an existing short position rather than entering a long position. After the Tweezer has completed, a subsequent price movement above the first candlestick’s real body could indicate that a bullish reversal is possible. In the short to medium term, following the Tweezer Bottom pattern, the trader should watch out for the appearance of another bearish candlestick pattern, such as the Hammer pattern, a bullish Engulfing pattern, or a Three White Soldiers pattern, as these could mark the start of an uptrend and could be used to enter a long position.