The Shooting Star Candlestick Pattern

What is the Shooting Star Pattern?

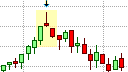

The Shooting Star Pattern

The Shooting Star is a triple candlestick pattern that is similar to the Evening Star in that it is a bearish top reversal pattern that may appear in an uptrend and warns of a possible trend reversal. Where the Shooting Star differs from the Evening Star is in the shape of the middle candlestick that is the Star in the pattern, which, in the case of the Shooting Star , is an inverted umbrella line with a long upper shadow and no or very little lower shadow, much like a "Shooting Star " racing across the sky. Thus, the Star in the Shooting Star pattern takes the form of an Inverted Hammer rather than a small Doji or a Spinning Top as in the Evening Star.

The Shooting Star Formation

The Shooting Star consists of three candlesticks, with the middle candlestick being a small Star that takes the form of an inverted umbrella line. The first candlestick in the Shooting Star must be supportive of the uptrend and, hence, must be light in color and must have a relatively large real body. The second candlestick is the Star, which is a candlestick with a short real body that gaps away from the real body of the preceding candlestick. The gap between the real bodies of the two candlesticks, and the large size of the first candlestick are the two conditions that makes the second candlestick a Star. The Star can form within the upper shadow of the first candlestick but its real body must not overlap the real body of the previous candlestick.

In the Shooting Star pattern, the Star takes the form of an inverted umbrella line. An inverted umbrella line is a candlestick that has a short real body that is located at the lower end of the price range, very little or no lower shadow, and a long upper shadow. The upper shadow must be at least twice the length of the candlestick's real body. The short real body of the umbrella line renders the color of its real body as having no significance.

The Star is followed by the third candlestick in the pattern, which must be a bearish, dark-colored candlestick that closes well into the real body of the first candlestick.

What the Shooting Star Pattern tells us

The first candlestick in the Shooting Star pattern is a large candlestick that is supportive of the uptrend. It suggests that the bulls are very much still in control of the market. However, the next candlestick, with its small real body and long upper shadow is the first indication of weakness in the uptrend. The long upper shadow indicates that the bulls were not able to maintain their advantage and that the bears were able to dive the price back down to close much closer to the opening price for that session. This weakness among the bulls and the increasing strength of the bears is confirmed by the next candlestick in the pattern as this is a relatively large, bearish candlestick that closes well into the body of the first candlestick or below above it.

A bearish downtrend can now be expected to emerge as any bulls that bought on the first two candlesticks in the pattern will be under pressure to close out their positions by becoming sellers, adding to the bearish reversal pressure.

Trading the Shooting Star Pattern

The Shooting Star pattern is a major bearish trend reversal pattern that warn of a possible transition to a downtrend. Once the formation of the Shooting Star pattern has completed the trader would look to close any long positions and initiate short positions. A trader with open long positions would thus look to close their long position on the open of the next candlestick. Traders will also look to initiate short positions on at the same point, i.e., on the open of the next candlestick.

Since a short position would be taken against the current uptrend, a protective stop-loss order should be used to limit the risk of the pattern failing. This protective stop could be placed just above the high of the Star would be an ideal place for a stop order as a break above the Star would invalidate the reversal signal. Thus, the area just above the Star in this pattern would be an ideal location to place a protective stop-loss. If the Star has a long upper shadow, the placement of the protective stop-loss may be too far from the entry to provide a favorable risk/reward ratio. In this event, the trader could wait for a possible pull-back towards the potential resistance area represented by up gap below the Star before entering the trade. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur.

The Shooting Star pattern does not provide a clear profit target but previous levels of support or previous area of consolidation could be used as an initial price target. A trader could also implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bullish candlestick formation, or a simple trailing stop.

The reliability of the Shooting Star is enhanced if the third candlestick gaps below the real body of the Star leaving a gap between the real bodies of the Star and the two candlesticks on either side of it. This, however, occurs very rarely. Reliability is also enhanced by the extent to which the real body of the third candlestick penetrates the real body of the first candlestick, and if the third candlestick has very little or no lower shadow. Finally, volume should also be considered as the pattern is more reliable if the volume on the first candlestick is lower and the volume on the third candlestick is higher.

As always, the risk/reward ratio should be taken into consideration and disciplined money management should be exercised whenever a trade is entered into.