Ralph N. Elliott

Ralph Nelson Elliott (28 July 1871 – 15 January 1948) is known as the founder of the Elliott Wave Principle or Elliott Wave Theory. He was born in Marysville, KSKansas on 28 July 1871 and became a qualified account in the mid-1890s and worked mainly for railroad companies in Central America. During his time in Central America, Elliott contracted an intestinal illness, which forced him into retirement in 1929. It was during his battle with his illness that Elliott undertook a study of the behavior of the US stock market to occupy his mind. During this study he noticed the presence of a repetitive cyclic wave pattern on the price charts of the Dow Jones industrial averages. This wave pattern was first described by Elliott in a booklet entitled The Wave Principle in 1938 and was elaborated on in his book entitled Nature's Law: The Secret of the Universe in 1946. Elliott identified these as natural cycles in collective investor psychology, or crowd psychology, that moves from optimism to pessimism and back again.

On January 15th, 1948, two years after the publication of Nature's Law: The Secret of the Universe, and at the age of 76, Elliott passed away.

Unfortunately, Nature's Law: The Secret of the Universe has been out of publication for a few decades now, but the Elliott Wave Principle has been popularized in the 1980s following the work of A.J. Frost and Robert R. Prechter. Prechter had discovered Elliott's works while working as an analyst at Merrill Lynch in the min-1970s. In 1978 Frost and Prechter published the book, Elliott Wave Principle: Key To Market Behavior. The following year Prechter left Merrill Lynch and started the Elliott Wave Theorist. Prechter used Elliott wave analysis to correctly forecast the bear market in gold and the bull market in stocks in the 1980s. These forecasts led to the popularization of Elliott's wave principle.

Elliott's Wave Principle

Elliott Wave Structure

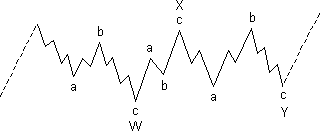

In Elliott's wave principle, the market price moves in an alternating cycle of five wave and three wave patterns, with the five wave pattern being an impulsive or motive phase, and the three wave pattern being a corrective phase. These two patterns form a complete cycle. Furthermore, Elliott found that these waves were present in all time-frames and discovered that a wave would consist of smaller subwaves, or waves of a lesser degree, although these smaller subwaves did not necessarily correspond to a smaller time-frame.

Elliott divided waves into two categories: impulse or motive waves and corrective waves, with impulse wave generally subdividing into 5 subwaves, and corrective waves generally subdividing into 3 subwaves. This is a general characteristic as these waves may have extensions, making them longer, without changing their technical significance.

Elliott also noticed that impulse waves do not always indicate a price advance and a corrective wave does not always indicate a price decline. Instead, impulse waves move in the direction of the wave one higher degree. Thus, in an impulse wave, subwaves 1, 3, and 5 are also impulse waves while subwaves 2 and 4 are corrective and move against the direction of the higher wave. Similarly, in a corrective wave, subwaves A and C are impulsive while subwave B is corrective.