Triple Top and Triple Bottom Patterns

The triple tops and triple bottoms patterns are similar to the double tops and double bottoms patterns that appear on line, bar, candlestick charts, and Point-and-Figure charts. They are short-term trend reversal patterns with the triple top being a bearish trend reversal pattern and the triple bottom being a bullish trend reversal pattern.

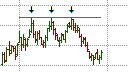

Triple Tops

The Triple Tops Pattern

The triple top pattern is a bearish trend reversal pattern that often marks the end of an uptrend and the start of a down trend. It consists of three consecutive peaks that reach a resistance level at more or less the same high value, with valleys creating clear separations between three distinct peaks. The low of the valleys is important for price projection purposes as is the volume. Preferably, the volume at each successive peak should be lower than the volume on the preceding peak.

Entry Signal

The triple tops pattern has only entry signals to sell short. This signal is triggered when the price breaks below the support level created on the lowest low of the two valleys. This break should preferably be accompanied by an increase in volume as a drop in volume may indicate a false break.

Price Projection

A price projection for the triple tops formation is similar to that of the double top. It is calculated by taking the distance from the support level formed at the low of the intervening valleys to the top of the peaks and subtracting it from the point at which the support level was subsequently broken. However, the price will usually attempt to retest the previous support level, which would now become a resistance level and may even violate this level before the down trend takes effect. Should the resistance level be broken on strong volume you should be cautious and perhaps exit the trade, looking to re-enter when the price breaks down below the resistance level.

Triple Bottoms

The triple bottom pattern is the bullish trend reversal counterpart to the triple top pattern. It often marks the end of a down trend and the start of an uptrend. This pattern consists of three consecutive and distinct dips that reach a support level at more or less the same low value, with peaks creating clear separations between three dips. The high reached by the peaks is important for price projection purposes. The volume is also important. Preferably, the volume should increase as each successive dip is formed.

Entry Signal

As with the triple bottom pattern, the triple top pattern has only entry signals to buy long. This signal is triggered when the price breaks through the support level created on the highest high of the two intervening peaks and closes above it. This break should preferably be accompanied by an increase in volume as a drop in volume may indicate a false break.

Price Projection

A price projection for the triple bottom formation is similar to that of the double bottom. It is calculated by taking the distance from the resistance level formed at the high of the intervening peaks to the bottom of the dips and adding it to the point at which the resistance level was subsequently broken. However, the price will usually attempt to retest the previous resistance level, which would now become a support level and may even violate this level before the uptrend forms. Should the support level be broken on strong volume you should be cautious and perhaps exit the trade, looking to re-enter when the price breaks up above the support level.