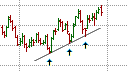

Trendlines

Trendline connecting correction lows

Trendlines are key elements of technical analysis and chart patterns as they indicate significant price levels where support of resistance could be expected to be encountered. Thus, an understanding of trendlines, and what they represent, is important for successful trading based on technical analysis.

Higher Lows for an Uptrend

In an uptrend, which is characterized by higher highs and higher lows, with the higher lows referred to as correction lows or reaction lows as the market corrects an overbought condition, a trendline can be drawn below the correction lows connecting two or more of the lows. A trendline that connects only two correction lows is a tentative trendline and is only confirmed when the price test the line successfully, i.e., the price touches the line and bounces of it, for a third time. When a trendline has been identified, it can used to identify potential areas of support for subsequent correction lows. Should the price break the trendline, i.e., penetrate or violate the trendline and close below it, then trend could be broken. However, only a lower low will confirm a reversal of the uptrend. In addition, an increase in volume at the break increases the validity of that break while a decrease in volume increases the probability of a false break. Furthermore, the actual drawing of trendlines is more of an art than a science and take a bit of time to get right. As a guideline, drawing the trendlines along areas of congestion rather than at the tips of the spikes is the preferred method for most technical analysts. A more detailed discussion of this is included in our lesson on how to draw trendlines.

Lower Highs for a Downtrend

Higher Lows and

Lower Highs

The same is true for a downtrend, which are characterized by lower lows and lower highs. The lower highs are referred to as reaction or correction highs as the market attempts to correct oversold conditions. A trendline can be drawn above the trend to connect two or more correction highs. When the trendline connects only two correction highs, it is a tentative trendline and is only confirmed when the price tests the trendline a third time without violating it. These trendlines are potential areas of resistance for subsequent correction highs. When the price penetrates the trendline and close above it, then trendline could be broken but a reversal of the downtrend is only confirmed by a higher high.

Significance

The strength or significance of a trendline is directly proportional to the number of points which touch the trendline. This represents every time the price returned to test the trendline without violating it. In addition, trendlines on charts with longer time frames have a greater significance than trendlines on charts with shorter time frames.

Further Reading

For more information on trendlines, have a look at our educational module on Price Action that includes lessons on how to draw trendlines, when and how to adjust trendlines, strategies for trading trendline patterns.