Reversal Patterns

Reversal Patterns

Reversal patterns indicate a high probability that the existing trend has come to an end and that there is good chance of the trend reversing direction. They give entry signals early in the formation of a new trend, making their entries quite lucrative, with fairly small protective stops. However, the trend might not reverse immediately and may enter a trading range instead.

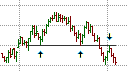

As with trend continuation patterns, there must be an existing trend that is to be reversed. Without a pre-existing trend reversal patterns are not valid. The common reversal patterns include double tops and double bottoms, triple tops and triple bottoms, head and shoulders, rising and falling wedges, and the less common rounded tops and rounded bottoms.

This section covers classical Western reversal patterns found on bar chart and candlestick charts. Japanese reversal patterns differ from Western reversal patterns. Click here for a discussion on Japanese reversal patterns.