The Morning Star Candlestick Pattern

What is the Morning Star Pattern?

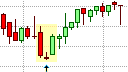

The Morning Star Pattern

The Morning Star candlestick pattern is a bullish, bottom reversal pattern that consists of three candlesticks, of which the middle candlestick is a Star. It is the antithesis of the bearish Evening Star that is also a triple candlestick pattern. The Morning Star pattern is also similar to the Abandoned Baby Bottom pattern with the exception that the Star in the pattern need not gap away completely from the other two candlesticks in the formation. Like the Abandoned Baby Bottom pattern, the Morning Star warns of weakness in an existing downtrend that could potentially lead to a trend reversal and the establishment of a new uptrend.

The Morning Star Formation

The Morning Star consists of three candlesticks with the middle candlestick taking the form of a Star. The first candlestick in the Morning Star pattern must have a relatively large real body and must move in the direction of the downtrend. In other words, its real body must be large and dark in color. The second candlestick is the Star, which has a very short real body that gaps away from the real body of the first candlestick. The gap between the real bodies of the two candlesticks and the relatively large size of the preceding candlestick is what distinguishes a Star from a Doji or a Spinning Top. The Star does not need to form below the low of the first candlestick and can exist within the lower shadow of that candlestick. The Star is followed by the third candlestick, which must be a bullish, light-colored candlestick that closes well into the body of the first candlestick or above it.

When the Star in the pattern is a Doji, pattern is called the Morning Doji Star pattern.

When the Star in the pattern is a Doji, it is called the Morning Doji-Star pattern and when the Star gaps away from both the first and the last candlesticks in the formation, it is called the Abandoned Baby Top pattern.

What the Morning Star Pattern tells us

The first candlestick in the Morning Star pattern is supportive of the downtrend. Its relatively large real body indicates that the bears are still in control of the market. However, the next candlestick, which is the Star, is the first indication of weakness in the downtrend as it indicates that the bears were unable to drive the price much lower despite the gap down. Its small real body also reflects the weakness in the downtrend, with the color of the candlestick's real body having no significance. This weakness is confirmed by the last candlestick in the pattern. This candlestick is a bullish, light-colored candlestick that moves against the current downtrend and closes well into the real body of the first candlestick or even above it.

A transition to a bullish uptrend can now be anticipated as any bears who opened short positions on the first candlestick in the pattern will be under pressure to cover their short positions by buying the market, adding to the bullish reversal pressure.

Trading the Morning Star Pattern

Once the Morning Star pattern has completed, a trader would anticipate going long as the Morning Star is a bullish trend reversal pattern. Traders with existing short positions would want to close those shorts on the open of the next candlestick. This is also where traders would place buy orders to open long positions. The low of the Star in the pattern would be an ideal place for a protective stop-loss as a break below the Star would invalidate the reversal signal. If the placement of the protective stop-loss is too far from the entry to provide a favorable risk/reward ratio, the trader could wait for a possible pull-back towards the potential resistance area represented by up gap above the Star before entering the trade. This would place the entry much closer to the protective stop and would reduce the capital at risk on the trade, though there is no guarantee that a pull-back will occur.

The Morning Star pattern does not provide a clear profit target but previous levels of support or previous area of consolidation could be used as an initial price target. A trader could also implement a profit target based on a defined risk/reward ratio, a measured move, or some other trading mechanism can be used to exit the trade. This could be a Fibonacci retracement level, the appearance of a bearish candlestick formation, or a simple trailing stop.

As with the Evening Star, the reliability of the Morning Star is enhanced if the third candlestick opens above the real body of the Star leaving a gap between the real bodies of the Star and the third candlestick, though, this does not occur very often. Reliability is further enhanced by the extent to which the real body of the third candlestick pierces the real body of the first candlestick, especially if the third candlestick has little or no upper shadow. Reliability is also enhanced if the volume on the first candlestick is below average and the volume on the third candlestick is above average.